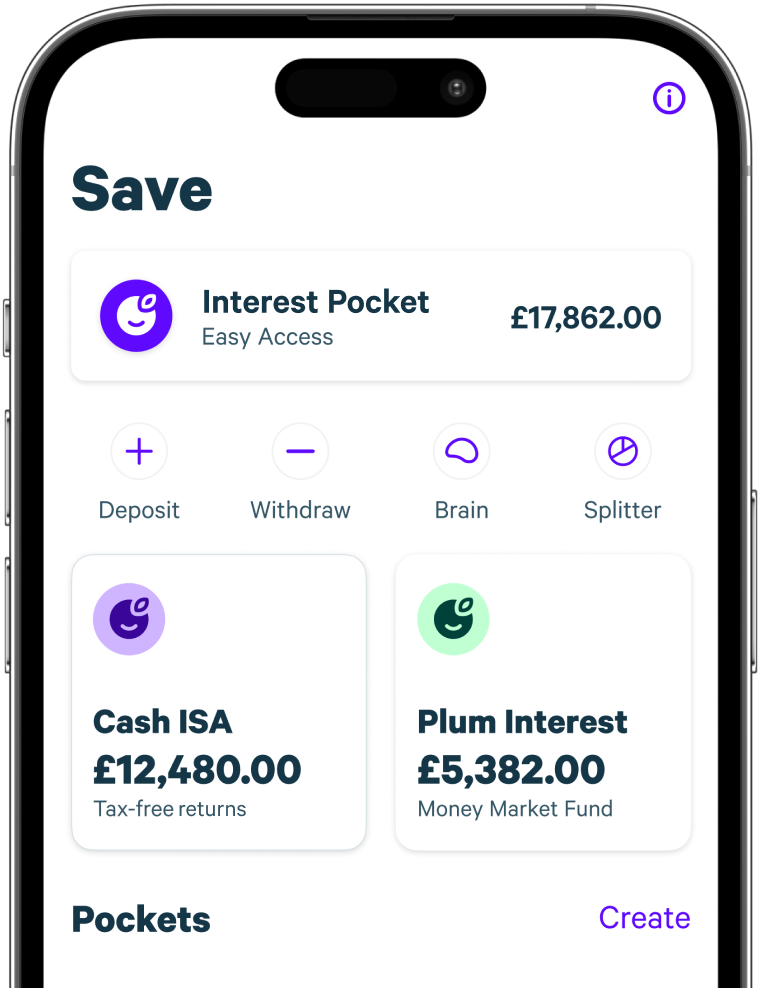

Interest Pockets

Get up to 4.70% AER

Open in 5 minutes

on iOS or Android

Interest Pockets are provided by Investec Bank Plc (Opt-in). Find out more information about how your savings are protected via our FSCS Information Sheet and Exclusion List. Easy Access Interest Pockets are not the same as Plum Interest.

Reach your goals

Create and customise an Interest Pocket for your saving targets and assign a goal to reach it quicker.

Withdraw anytime

Whether you’ve reached your savings goals or you just need some extra cash to cover an emergency, you can withdraw anytime, completely free, within the same working day (up to 3 pm).

FSCS protected

Money deposited in your Interest Pocket is protected by the Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person. Read more on how your money is protected here.

Summary Box

The Interest Pocket provided is named Easy Access Interest Pocket.

The Easy Access Interest Pocket provides an interest rate of 4.70% AER variable for Plum Premium subscribers, 4.15% for Plum Pro and Ultra subscribers, and 4.00% AER for Plum Basic customers. The Interest is calculated daily on the cleared balance in the account using the interest rate applicable on that day and is paid into the Interest Pocket monthly.

The interest rate is variable and we also have the right to change these rates, so it can go up or down. When that is the case, we will notify you (email & app notifications) that this change will take effect in a minimum of 14 days for Easy Access as per clause 18 of our Interest Pockets Terms.

There is no fee for these accounts. The Easy Access Premium account (4.70% AER) is exclusive for Plum Premium subscribers (starting from £9.99 per month), the 4.15% AER rate is exclusive for Plum Pro & Ultra subscribers (starting from £2.99 per month) and the Easy Access Free account (4.00% AER) is available to all Plum customers.

Plum gets the interest rate from our Interest Account provider (Investec Bank Plc.).

If you deposited £1,000 and didn’t withdraw for 12 months, the balance would be £1,042.10 if you’re a Plum Premium subscriber (4.70% AER), £1,037.20 if you’re a Plum Pro & Ultra subscriber (4.15% AER) and £1,035.10 if you’re using Plum for free on the Basic tier (4.00% AER).

Assuming that:

◦ The account is opened with £1,000

◦ No further deposits or withdrawals are made

◦ The interest stays the same for the full 12 months

There are no fees for these accounts, but bear in mind, the Easy Access (4.70% AER and 4.15% AER) is part of the Plum Plum Pro/Ultra/Premium subscription bundle starting for as little as £2.99/month.

Plum gets the interest rate from our Interest Account provider (Investec Bank Plc.).

The account is available to UK residents aged 18 or over. You may only open and manage the account via the Plum app. No minimum deposit or upper limit.

With Plum Free & Plus, you can open one Easy Access Interest Pocket, while under Plum Pro, you can open up to 10 different Easy Access Interest Pockets. Money in interest pockets are cumulatively protected along with any other accounts you may hold at Investec Bank Plc, by FSCS up to £85,000.

You can withdraw money from your Plum Interest Pockets at any time by tapping the ‘Home’ menu button and then clicking ‘Withdraw’ from the Interest Pockets with no limits or fees. Withdrawals are paid within the same working day (up to 3PM).

Interest is paid without tax being deducted. Your tax treatment of any interest will depend on your individual circumstances.

If you have any questions, feel free to 'chat to a human' within the Plum app 👋

If you have any other questions you can visit the full FAQ.

Let's get started

Download the app now to join 2 million people already on their way to scoring their financial goals.

on iOS or Android